The reporter recently noticed that many bank apps have refined the customer level after the updated version. The refinement of membership level reflects the refinement trend of bank retail strategy.

It is not difficult to find that under the superposition of technology empowerment and non-contact finance, the coverage of China’s retail financial market tends to be saturated, and the staking has been completed in terms of scenes, payment and credit. In the future, the focus will be on the refined management of stock customers.

China Merchants Bank divides customers into 9 levels.

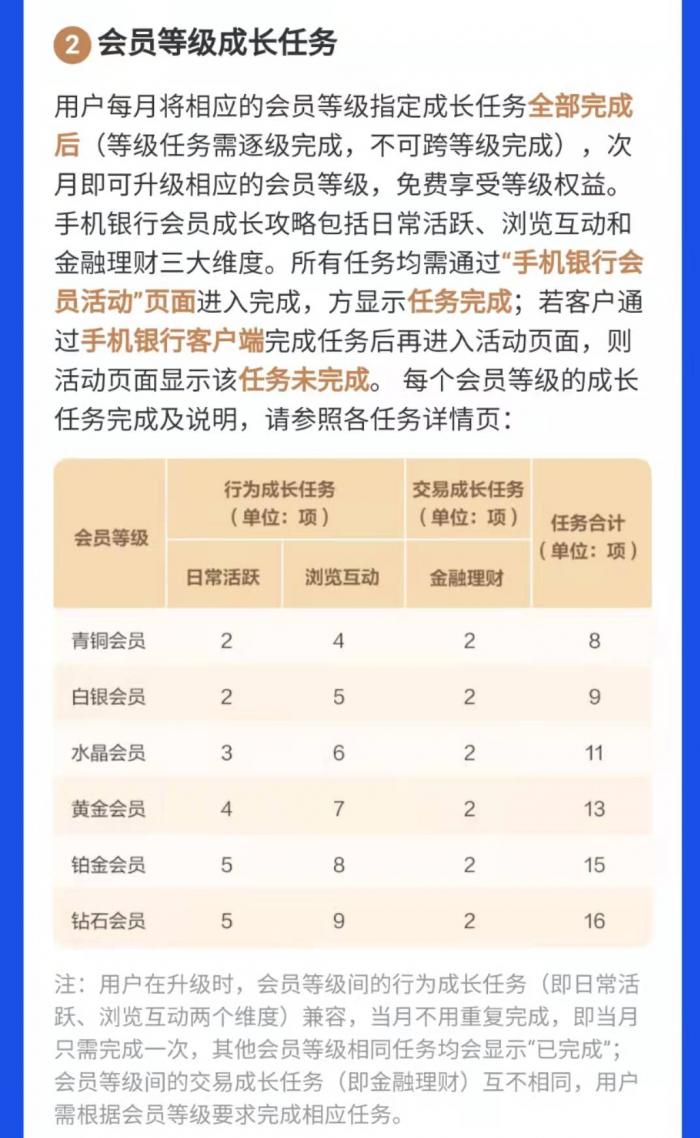

Recently, CCB has divided its members into six grades: bronze members, silver members, crystal members, gold members, platinum members and diamond members. The differentiation of grades is mainly determined by three dimensions: daily activity, browsing interaction and financial management. The higher the membership level, the higher the rights and interests you can enjoy. The rights and interests are mainly distributed in the form of card coupons, including Hungry, Meituan, Shouyue Car, Fan Deng Reading, Fruit Voucher, Didi Chuxing, JD.COM/Tmall Shopping Card, etc.

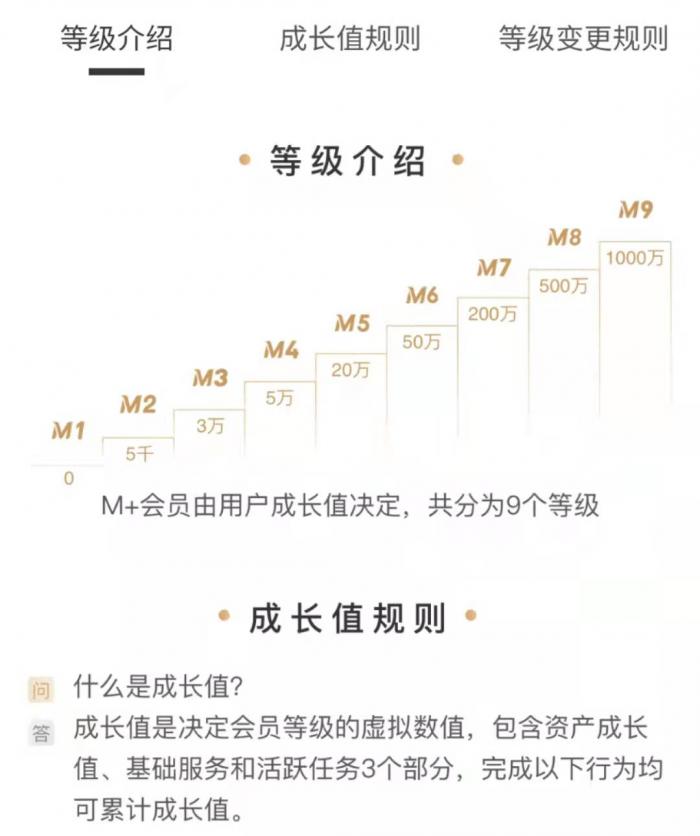

China Merchants Bank (600036) has a finer hierarchy of customers, which divides customers into nine levels according to three dimensions: asset growth value, basic services and active tasks, and each level has corresponding rights and interests services. For example, M1 level has nine rights and interests, including gold red envelope, credit card repayment, family health insurance, birthday present, travel discount, credit report, credit card repayment of other banks, credit card installment and e-loan promotion.

China Merchants Bank told reporters that China Merchants Bank launched the M+ membership system in 2020, accompanying customers’ wealth growth through the circular chain of tasks, grades and rights, continuing to deepen refined management and striving to provide better services to customers.

ICBC divides customers into eight grades according to their financial assets, and the corresponding grades can enjoy different rights and interests in entertainment, study, food, travel and health.

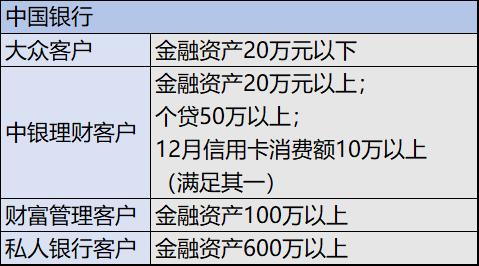

China Bank is relatively simple, divided into four levels: mass customers, BOC wealth management customers, wealth management customers and private banking customers.

Hierarchical operation has a long history.

A person in charge of the wealth management department of an East China city commercial bank told reporters that the hierarchical management of customers has always existed. On the one hand, this stratification reflects the importance that banks attach to the management of different customers. For example, in addition to exclusive financial consultants, private bank customers also provide legal, tax and health consulting services; On the other hand, in order to give different customers corresponding rights and interests, such as no queuing, VIP service at the airport and products only for specific customers.

China Merchants Bank told reporters that it is a common practice in the industry to stratify the customer base according to the asset size. With the deepening of customer service, in order to enhance the customer experience and strengthen the connection between App and customers, China Merchants Bank began to think more about how to finely classify and differentiate customers, and tried to superimpose personalized services according to customer characteristics and market rules to meet the needs of different customer groups, such as providing online service areas for college students to shorten offline business processes, providing pet insurance for cute pet families, providing convenient online and offline experience for older customers, and providing family trust planning for high-net-worth customers.

The concept of customer stratification originated in the mid-1950s and was put forward by Wendell Smith, an American scholar. Its theoretical basis is mainly in two aspects, namely, the heterogeneity of customer demand and the limitation of bank resources. Customer stratification is a process of subdividing a bank’s customer base according to different dimensions on the premise of limited resources and heterogeneous demand, so as to provide customers with refined and accurate services.

It can be understood that because each customer brings different value to the bank, their needs and expected treatment for the bank will also be different. Key customers who bring greater value to banks expect to be treated differently from ordinary customers, such as more intimate products or services and more favorable conditions.

If banks can distinguish these customers who contribute a lot to profits and provide them with targeted services, they may become loyal customers of banks, thus creating more profits for banks continuously.

"28 Rule" in Bank Customer Operation

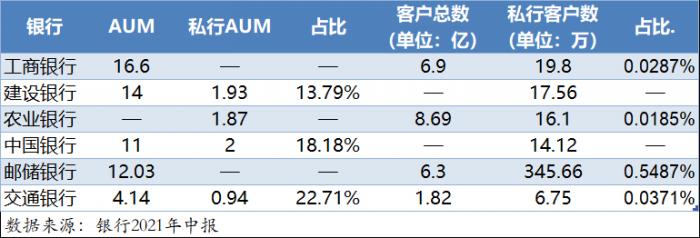

For the bank’s customer operation, the "28 Rule" is very applicable, and a small number of private bank customers contribute most of the asset management scale (AUM). According to the "28 Rule", if a bank can serve these 20% key customers well, it will bring 80% revenue increase, but in practice, the proportion of key customers is far less than 20%, but the AUM brought by it is very considerable.

Taking the data of six major state-owned banks’ mid-year reports in 2021 as an example, the AUM of Bank of Communications continued to maintain rapid growth in the first half of 2021, with a scale of 4,139.472 billion yuan at the end of the reporting period, an increase of 243.906 billion yuan or 6.26% over the end of last year; Among them, 943.762 billion yuan was managed by private banking clients, an increase of 13.19% over the end of last year. At the end of the reporting period, there were 182 million domestic retail customers (including debit and credit card customers), an increase of 1.71% over the end of last year; There were 1,904,800 Ward customers (customers with quarterly average assets ranging from 500,000 yuan to 6 million yuan), an increase of 9.67% compared with the end of last year, and 67,500 private banking customers of the Group, an increase of 10.46% compared with the end of last year.

It can be seen that 0.0371% of customers contributed 22.71% of the assets.

From the data of other banks, we can also see that AUM, a very small number of private customers, accounts for a very high proportion. At the end of June, the scale of financial assets of individual customers of China Construction Bank was 14 trillion yuan, of which private banks were 193 million yuan, accounting for 13.79%. The total financial assets of individual customers of China Bank exceeded 11 trillion yuan, of which the financial assets of private banks were 2 trillion yuan, accounting for 18.18%.

In terms of the number of customers, ICBC had 690 million individual customers at the end of the reporting period, including 198,000 private banking customers, accounting for 0.0287%; The total number of customers of Agricultural Bank is 869 million, and the number of private customers is 161,000, accounting for 0.0185%; The Postal Savings Bank has 630 million customers and 3,456,600 wealth customers, accounting for 0.5487%.

Except for the Postal Savings Bank, whose statistical caliber is wealth customers, the number of private customers in other banks is far below 0.05%. But it is these five ten thousandths of customers who contribute more than 10% of AUM.

Therefore, it is not difficult to understand why many banks have made frequent moves in private banking this year.

On December 15th, the Private Banking Department of Nanjing Bank (601009) was formally established. As the first-level department of the head office, the private banking department of the bank will be positioned as the "profit center", "asset allocation center" and "public-private linkage center" of the whole bank to help the in-depth implementation of the big retail strategy. So far, Bank of Nanjing has formed a "private drilling customers-wealth customers-basic customers-Internet customers" total retail layered service management system, providing differentiated services for different customer groups. By the end of November 2021, retail customers’ AUM exceeded 560 billion yuan, an increase of over 15% compared with the end of last year; The total number of retail customers exceeded 23 million, an increase of over 8% compared with the end of last year, among which the scale of private drilling customers exceeded 34,000, and the scale of wealth customers exceeded 560,000.

On December 21st, Shanghai Banking Insurance Regulatory Bureau approved the opening of the private banking department of Industrial Bank (601166) and issued the Financial License, which is also the first private banking franchise institution formally established by joint-stock banks.

On the 22nd, hengfeng bank also announced that the main preparatory work for the private banking department has been completed, and submitted an application for opening in accordance with relevant regulations and procedures. According to the approval, hengfeng bank should complete the preparatory work within 6 months from the date of approval, and accept the supervision and guidance of Shanghai Banking Insurance Regulatory Bureau during the preparatory work. After the preparatory work is completed, it will apply for opening in accordance with relevant regulations and procedures.

How to serve "long tail" customers

The long tail theory focuses on small and medium-sized customers, and increases profits by expanding the base, thus achieving economies of scale. In the case that the acquisition of new customers has encountered a certain bottleneck, operating existing customers well is a great weapon to improve the bank’s profits, which requires banks to pay attention to every customer and transform from extensive management mode to refined management mode. In addition, banks also have certain social responsibility requirements for financial inclusion, so they should pay more attention to the vulnerable groups in society. For long-tail customers, they need to change their business models, innovate products and improve customer stickiness.

China Construction Bank’s mid-year report in 2021 pointed out that it will further promote the digital operation of public and long-tail customers. At the end of June, the total number of RMB settlement accounts of CCB units was 11,863,600, an increase of 404,800 compared with the end of last year; There were 1,847,800 active customers in cash management, an increase of 171,700 over the same period of last year.

In the face of a large number of "long tail" customers, manual service will cause a sudden increase in costs, so financial technology has become a breakthrough point in serving such people.

The above-mentioned city commercial bank people told reporters: "Customers who serve the’ Long Tail’ can send notices through the bank APP, or directly send millions of text messages to directly contact them."

As mentioned above, the bank’s rights and interests services are increasingly rich, but how to distribute rights and interests, match customers and reach customers is still the industry pain point faced by major banks. Financial technology can solve some problems. For example, in September, Baorun Xingye, a subsidiary of Financial One Account, cooperated with Ping An One Wallet to jointly build a "cloud equity platform" based on Ping An Group’s equity resource pool, with equity as the starting point for customer management. However, the final result will be tested by time.