LI (02015.HK/LI.US) achieved a new high in the third quarter of this year. Both quarterly delivery volume and financial data were the best in history, and US stocks rose more than 7% before the market.

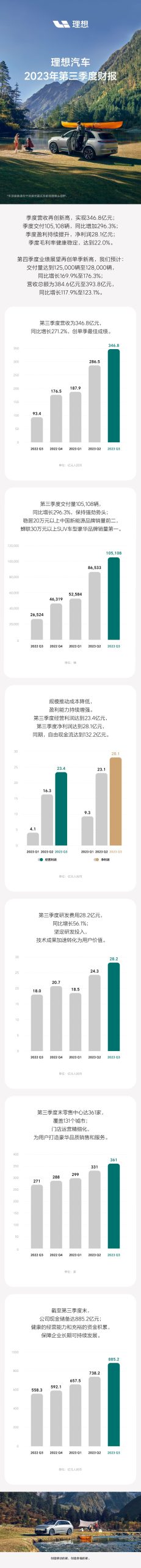

The financial report shows that in the third quarter of this year, LI’s revenue reached 34.68 billion yuan, a year-on-year increase of 271.2% and a quarter-on-quarter increase of 20.2%; The net profit was 2.81 billion yuan, exceeding the market expectation of 2.375 billion yuan, up 21.8% from the previous month, compared with a net loss of 1.65 billion yuan in the same period last year.

It is worth noting that this is the fourth consecutive quarter that LI has made a profit. For the new energy industry, although the market penetration rate has increased rapidly in recent years, many new energy vehicle companies have not yet achieved profitability. In particular, the new forces of building cars supported by capital are mostly in the stage of burning money. LI has achieved sustained growth in net profit, surpassing Tesla and BYD in gross profit margin.

Sustained profit

Automobile sales revenue is the main source of revenue. In the third quarter, automobile sales revenue was 33.62 billion yuan, up 271.6% year-on-year and 20.2% quarter-on-quarter. This is mainly due to the substantial increase in car delivery. LI delivered 105,100 new cars in the third quarter, up 296.3% year-on-year.

Since the beginning of this year, LI has developed rapidly and delivered more than 40,000 vehicles in October. Compared with other new energy vehicle companies, LI’s bicycle efficiency is higher, which reflects the ability to create explosions. At present, LI owns three L-series products, with monthly sales exceeding 10,000 vehicles. Although other new forces have a variety of products, it is difficult for bicycle sales to exceed 10,000. On the one hand, LI grasped the product market positioning accurately, and fully met the needs of consumers. On the other hand, compared with traditional luxury car companies with high brand premium, LI has a cost-effective advantage.

At present, the phenomenon of involution in the automobile market is serious, and the listing of a new product can easily impact the competition. With the intensification of competition, the iteration cycle of automobile products is getting shorter and shorter. Take the new M7 as an example. After the car went on the market, the sales of some products in this market segment declined. Some car companies will speed up the introduction of replacement products, and even reduce prices and increase distribution to compete for market share.

Judging from the market performance, the sales of the new M7 in Wenjie did not affect LI, and the sales volume in LI reached a new high in the third quarter. Li Xiang, CEO of LI, said: "In the face of Huawei, the management of LI has a unified understanding: 80% is learning, 20% is showing respect, and there is no complaint. As a start-up, we are still very admired and excited to meet such an example that we can learn from when we enter the scale of 100 billion income. This is our true mentality. "

The rapid development of new energy has reshuffled the market and the competition pattern has been reshaped. BYD’s momentum is still fierce after winning the automobile sales crown in 2022, which is mainly due to the strategy of the same price of oil and electricity to seize the market share of 250,000 yuan for fuel vehicles. LI’s products cost more than 300,000 yuan, and it is positioned as a high-end model. In this field, the market share of traditional luxury cars has been shaken. In the SUV market segment of more than 300,000 yuan, LI sold 231,000 vehicles in the first three quarters.

In the new energy vehicle market with a price of more than 200,000 yuan, the three head patterns of "Tebili" new energy have been formed, and the sales of these three head car companies have exceeded the sum of other brands. Among China brands, LI is only behind BYD, and LI’s share in Q3 reached 15.4%, up nearly 5 percentage points from the first quarter.

It is worth noting that this year, the auto market was caught in a price war, and LI resisted the market pressure and did not follow the tide of large-scale price reduction. At the same time, the increase in sales of high-priced models also boosted the growth of profitability. The main sales force in the third quarter of last year was Li ONE, and the price range was around 350,000 yuan. The ideal L9 began to increase rapidly in September. In the third quarter of this year, the main sales force was the ideal L series, and the price went up to the range of 460,000 yuan; Under the dual effects of delivery volume and product price, the total revenue has increased significantly. MEGA, the ideal new product listed at the end of the year, will cost more than 500,000 yuan.

According to the financial report data, in the third quarter of this year, LI’s gross profit was 7.64 billion yuan, up 546.7% year-on-year and 22.6% quarter-on-quarter. In terms of gross profit margin, in the third quarter of this year, LI’s gross profit margin reached 22.0%, with both year-on-year and quarter-on-quarter data rising.

In terms of cash reserves, LI’s free cash flow in the third quarter of this year was 13.22 billion yuan, up 37.5% from the previous month. By the end of the third quarter, cash reserves reached 88.52 billion yuan.

The goal of revenue of 100 billion is about to be achieved.

LI is expected to deliver 125,000 to 128,000 vehicles in the fourth quarter, up 169.9% to 176.3% year-on-year, and its total revenue will be 38.46 billion to 39.38 billion yuan, up 117.9% to 123.1% year-on-year. In the first three quarters of this year, LI’s accumulated revenue has reached 82.12 billion yuan, which means that the goal of 100 billion revenue will be achieved by the end of this year. It has also realized the transformation from an entrepreneurial enterprise to a large-scale automobile enterprise.

"The Changzhou manufacturing base in LI has completed the capacity upgrade, which is ready for further production climbing in the fourth quarter. In terms of supply chain management, it is ideal to strengthen efficient collaboration with suppliers by optimizing management strategies and upgrading management processes, and constantly break the bottleneck of parts supply. " Li Xiang said that at present, there are two production bases in Beijing and Changzhou, three production lines in Changzhou and one production line in Beijing. The current ideal production capacity can meet the sales and sales targets in the next two years. "

According to the strategic plan, LI adopts the dual-route layout of extended-range electric and pure electric, and the introduction of pure electric products will further promote the sales growth. Li Xiang said that the first 5C pure electric super flagship model Ideal MEGA will be officially released in December this year and will be delivered in February next year. "We believe that the ideal MEGA with 800V high-voltage platform and 5C charging rate will open a new chapter for LI in the pure electric market, and jointly promote the process of replacing traditional fuel vehicles on a large scale with extended range technology. At the same time, in line with the promotion of the pure electricity strategy, we are accelerating the construction of a super charging network to provide users with a more convenient and reliable charging experience. " LI plans to build more than 300 super charging stations by the end of this year, and increase the number to 3,000 in 2025 to support the demand of users of pure electric vehicles.

In addition, in addition to the first pure electric MEGA model to be launched in the fourth quarter, three pure electric models and one extended-range model are planned to be launched next year, which will make Ideal one of the most abundant new energy vehicle manufacturers.

At present, LI is increasing its R&D investment in the field of new technologies. In the third quarter of 2023, the ideal R&D expenditure reached 2.82 billion yuan, up 56.1% year-on-year and 16.1% quarter-on-quarter. The continuous increase of R&D expenses and healthy management ability will support LI to continuously increase R&D investment in four major technology platforms, including high-voltage pure electricity, extended-range electric, intelligent driving and smart space, as well as system R&D and technology development of cutting-edge projects.

"In the future, smart driving will be the goal of our core strategy. Our autopilot is about 900 people. It is planned that the number of R&D personnel for intelligent driving will exceed 2,000 next year and 2,500 in 2025. " Li Xiang said that in the future, it will increase investment in research and development including vehicle testing, computing power and personnel, and there will be sufficient cash reserves and cash flow to support it.

In the field of intelligence, in September this year, Ideal L series pushed OTA version 4.6 system to users, adding 25 functions and optimizing 10 experiences around the intelligent cockpit experience, creating more convenient and closer voice interaction function and APP interconnection experience for home users. Previously, based on a large model, LI built an urban NOA scheme that did not rely on high-precision maps. Compared with the small model algorithm, which is limited by the collection speed, update frequency and coverage of high-precision maps, the ideal city NOA has the ability to spread quickly throughout the country. At the same time, LI uses BEV big model to connect high-speed cities. After switching to big model algorithm architecture, the high-speed NOA functions of ideal AD Max and AD Pro platforms will be significantly optimized. According to the plan, LI will push the official version of AD Max 3.0 software to users this year, providing NOA capability of the whole scene, and push the software of AD Pro 3.0 to users in the first half of next year, which will greatly improve the driving assistance capability. "We are confident that we will become the first echelon of smart driving in the first half of next year." Li Xiang said.