Original scientific parenting editorial department scientific family parenting

November will soon be over. Describe your November in three words: discounted cooling; Life-threatening bill; Endless mycoplasma pneumonia, respiratory syncytial virus, influenza.

News photo source: Weibo (Beijing things that Beijingers don’t know)

Every year, the temperature has dropped, and the minor ailments such as fever and cough seem to have an appointment. They came together and tried to shut them out.

Because viruses that can cause symptoms of upper respiratory tract are commonly influenza virus, respiratory syncytial virus and adenovirus. ……

Image source: scientific family parenting original

Some people have symptoms such as sore throat, cough, low fever, etc., and the antigen is not positive when tested, so it may be that they have been recruited by other viruses. Generally speaking, it is unlikely that the antigen will be missed.

At this time, I mainly want to tell you how to distinguish these viruses, and whether the symptoms are "yang" or infected with influenza or respiratory syncytial virus?

Nowadays, popular science from all channels can be easily obtained, but it also brings disadvantages: disorder and anxiety. Therefore, I hope that my friends can see accurate and systematic popular science content, so as to avoid going to the doctor in a hurry and taking the wrong medicine.

Anxiety is useless and unnecessary. What you should do most is to know what you are doing!

Have you taken out all your notebooks? Class begins!

Is the baby cough the flu?

The incubation period of the common cold is about one day, and the onset is not urgent. The main symptoms are sneezing, stuffy nose, runny nose, sore throat or dry and itchy throat, slight cough, low fever and headache.

The incubation period of influenza is about 1~3 days, and the onset is mostly sudden. Local symptoms such as runny nose and cough are often mild, but its systemic symptoms are often serious, mainly as follows:

Fear of cold, fever (body temperature can be as high as 39~40℃), headache, dry throat, sore throat, weakness, and long-lasting symptoms are prone to serious complications such as pneumonia and myocarditis, and even lead to death.

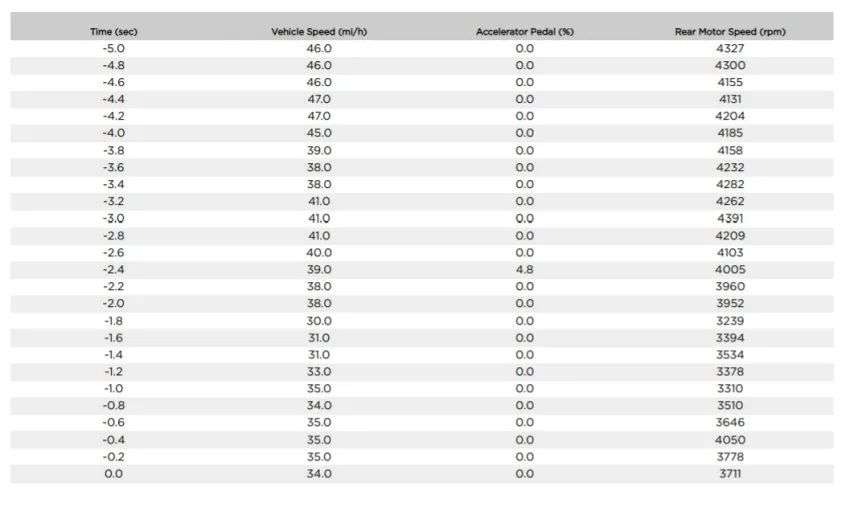

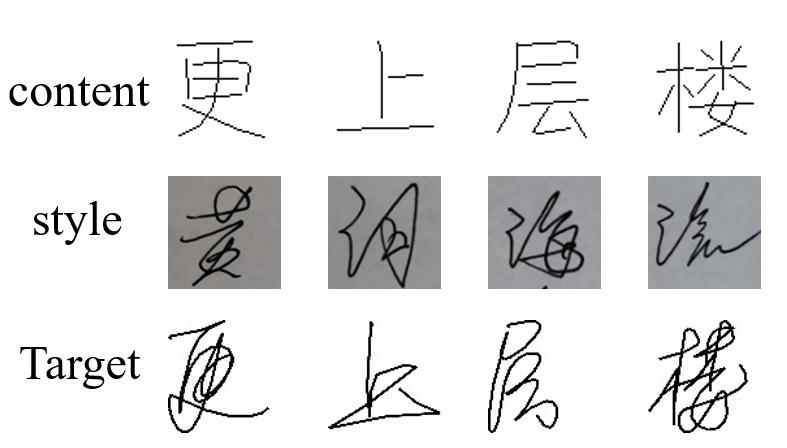

The difference between the common cold and flu.

Common cold flu

Pathogens: rhinovirus, coronavirus and respiratory syncytial virus, etc.

Pathogen: influenza virus

Non-communicable diseases

Class C infectious diseases (managed according to Class B)

The seasonality is not obvious

Mainly popular in winter and spring.

No fever or mild or moderate fever, no chills; There are almost no complications

High fever (39~40℃) with chills; Otitis media, pneumonia, myocarditis, meningitis or encephalitis may occur.

Fever for 1~2 days; The course of disease is 1~3 days.

Fever for 3~5 days; The course of disease is 5-10 days.

Almost no systemic symptoms

General symptoms are severe, including headache, muscle aches and fatigue.

The mortality rate is low

The mortality rate is high, and most deaths are caused by the acute aggravation of primary diseases (lung diseases, nervous system diseases and heart diseases, etc.) caused by influenza or the above complications.

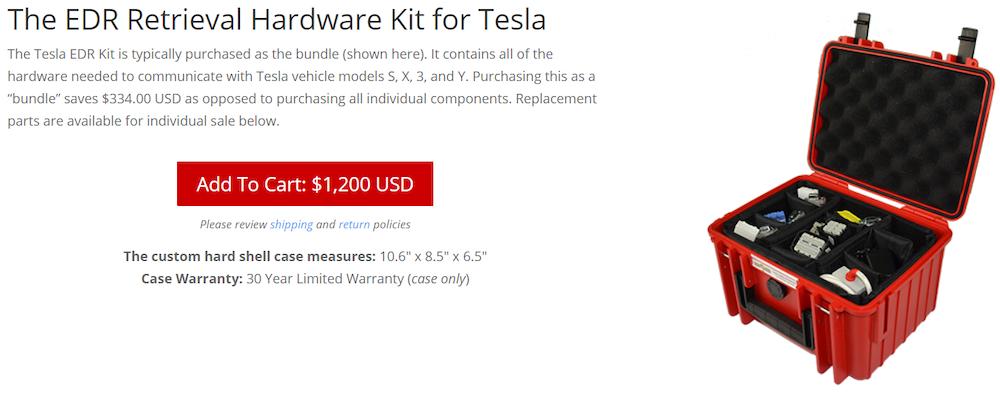

Because the symptoms of these viruses are similar, it is necessary to detect them if you want to judge them accurately.

General doctors in hospitals will make preliminary judgments according to clinical symptoms and improve all necessary examinations. For severe patients, it is necessary to collect lower respiratory tract samples, such as sputum or tracheal aspirate, and testing lower respiratory tract samples can make the results more accurate.

It can also be detected by antigen and nucleic acid, and RT-PCR detection has high sensitivity and specificity for influenza.

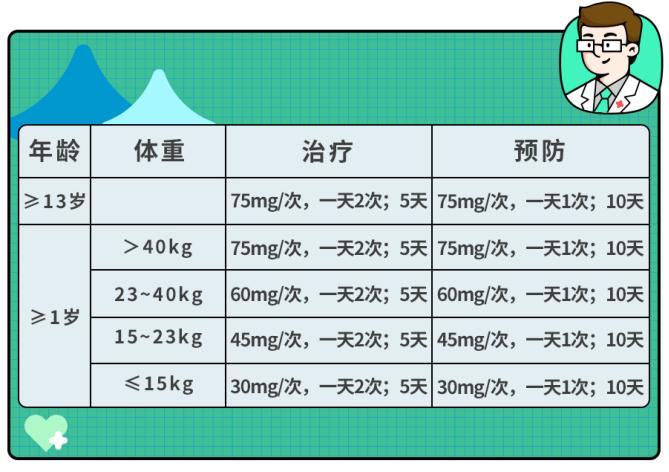

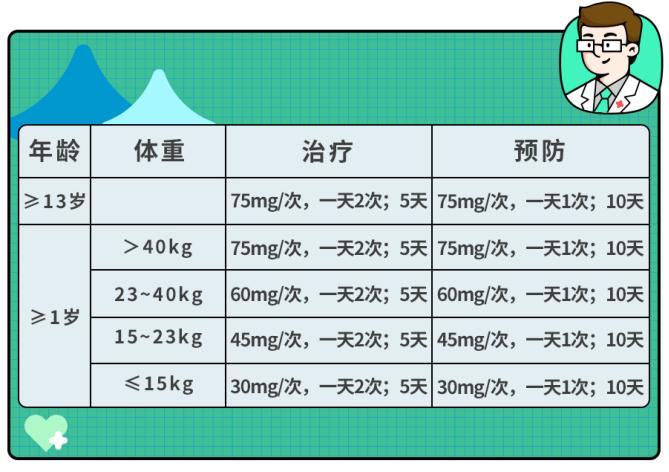

Regarding treatment and medication, the most recommended drug at present is oseltamivir, and it is best to take it within 48 hours of onset.

Oseltamivir is a prescription drug and should be used according to the doctor’s advice.

Especially for babies under 1 year old, parents should never arrange for their children themselves, and they need to be used under the guidance of a doctor.

Image source: scientific family parenting original

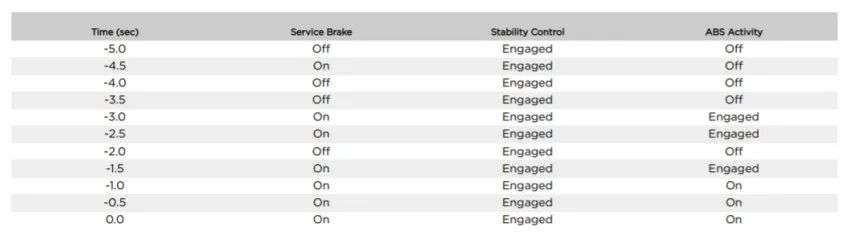

Teenagers and adults over 13 years old

75 mg each time, twice a day for 5 days.

Children over 1 year old

Take it according to the weight-dose table for 5 days.

Ps.5 days is a course of treatment, so you should follow the doctor’s advice and don’t stop taking the medicine without authorization, otherwise it will cause virus resistance.

↓ You can save the map directly for later use ↓

Image source: scientific family parenting original

Is baby cough respiratory syncytial virus?

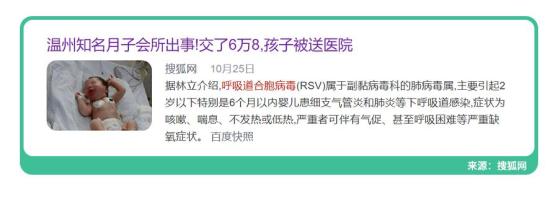

Respiratory syncytial virus (RSV) and influenza virus are collectively called "winter respiratory killer".

Image source: scientific family parenting original

After infection, it will cause lower respiratory tract infections such as bronchitis and pneumonia in babies under 6 months old. The infected baby may have different degrees of apnea, among which severe apnea is closely related to sudden death.

Older children are more often manifested as upper respiratory diseases such as rhinitis or colds, but it should be noted that children over 5 years old with basic diseases (such as nervous system diseases, immune deficiency, etc.) may also be hospitalized due to RSV infection.

Respiratory syncytial virus (RSV) is one of the viruses that can cause pneumonia and one of the most common respiratory pathogens in pediatrics.

Almost all children have experienced one or more infections before the age of 2.

In order to let people know respiratory syncytial virus more clearly, the department has greatly summarized its characteristics:

1. Respiratory syncytial virus is extremely lethal!

Respiratory syncytial virus is the main cause of pneumonia, bronchiolitis and even death in children under 5 years old.

It causes 34 million cases of respiratory infections every year, and the death toll of children under 5 years old is as high as 200 thousand.

Moreover, after natural infection with RSV, the immune protection time of the antibody produced is short, and it will be repeatedly infected.

2. Respiratory syncytial virus is highly contagious!

Respiratory syncytial virus (RSV) can be said to be one of the tenacious existence in the virus world, and it can survive for several hours on the surfaces of objects and unwashed hands everywhere!

It mostly occurs in crowded places, and its main transmission route is droplet and close contact.

It can be said that sneezing can be contagious.

If you come into direct contact with a virus-contaminated object or close contact with your body, such as touching or kissing someone who has been infected with the virus, you will be infected.

It takes about 4-6 days for symptoms to appear after infection.

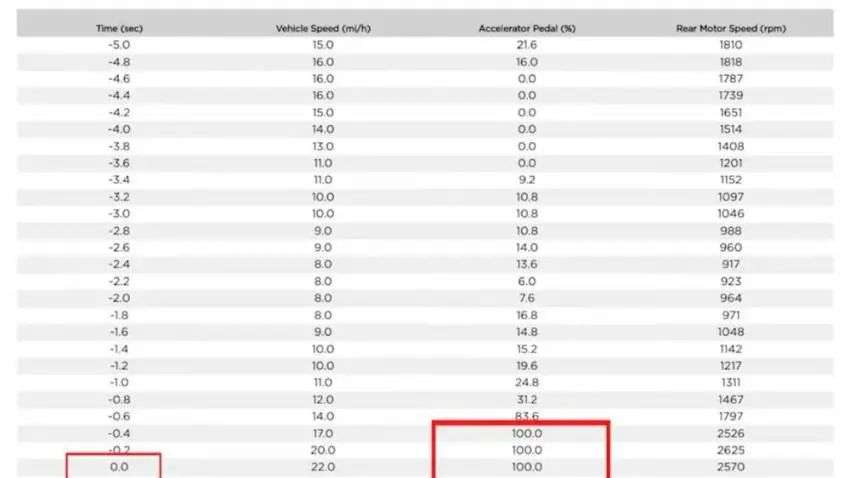

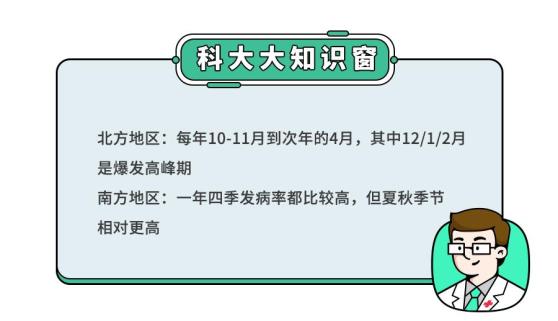

In addition, the time of high incidence in the north and south is different.

Image source: scientific family parenting original

3. respiratory syncytial virus specializes in picking soft persimmons!

Respiratory syncytial virus (RSV) is a "good hand" who bullies the weak and fears the strong. When choosing the target of invasion, we choose the people with "weak constitution" to start, and the department has greatly helped you to make an inventory:

Premature infants and infants under 6 months old

Among them, 2-6 months old is the peak age of bronchiolitis. Children within 6 weeks have a higher risk of severe RSV infection.

And the probability of male treasure infection is greater than that of female treasure.

Children with chronic lung disease, severe heart disease, abnormal immune function, cancer and organ transplantation are also at higher risk.

About 20% of lower respiratory tract infections in China are caused by RSV every year.

Beijing has investigated 1402 cases of infant viral respiratory tract patients, of which 66.1% were caused by the virus.

In developing countries, more than 300 million children under 2 years old are infected with RSV every year, resulting in respiratory diseases, and the death toll is as high as 2.5 million.

4. What is the difference between respiratory syncytial virus and cold?

The initial symptoms of RSV are very similar to those of a cold, with symptoms such as fever, stuffy nose or runny nose, mild cough and loss of appetite.

The common cold can be cured in about 5-7 days. If the baby has not recovered after this time and even has the following symptoms, it is necessary to consider that the baby is targeted by RSV.

● Breathing frequency is accelerated.

● Apnea exceeds 15-20 seconds.

● Continuous wheezing–that is, whistling when breathing.

● Severe cough

● Difficulties in eating or drinking water.

After children are infected with respiratory syncytial virus, their performance is also varied.

Image source: scientific family parenting original

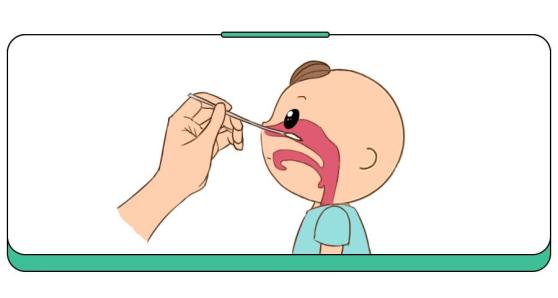

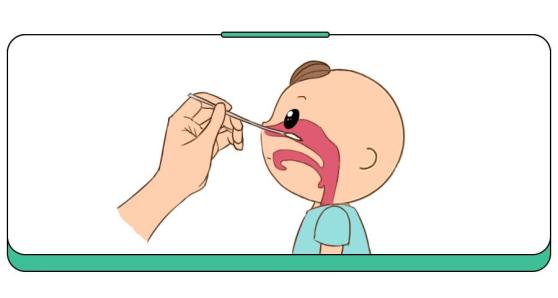

5. How to diagnose respiratory syncytial virus?

It is not that a baby can be diagnosed with fever, cough and wheezing.

If you are not sure whether it is respiratory syncytial virus infection, you can do nasal swab test to confirm the diagnosis.

Image source: scientific family parenting original

Respiratory syncytial virus (RSV) is a self-limiting disease, and antiviral drugs cannot be added immediately for infection!

Under normal circumstances, it can heal itself in 1-2 weeks, and the baby takes about 2-3 weeks; It is very important to give corresponding nursing care according to the severity of the disease during the course of the disease.

If the baby’s own immune system is defective and suffers from severe respiratory syncytial virus infection, it is necessary to use a ventilator. At this time, it is necessary to use antiviral drugs according to the doctor’s advice.

6. Will it recur after respiratory syncytial virus infection?

Not necessarily.

Respiratory syncytial virus has two subtypes, A and B, and each subtype is divided into different virus strains according to genotype.

Most of the two subtypes are prevalent at the same time every year, and the dominant virus strains keep rotating every year, which makes it impossible to prevent.

Image source: scientific family parenting original

Therefore, it is not that the infection will not recur once, and some babies will even be infected twice in an epidemic season.

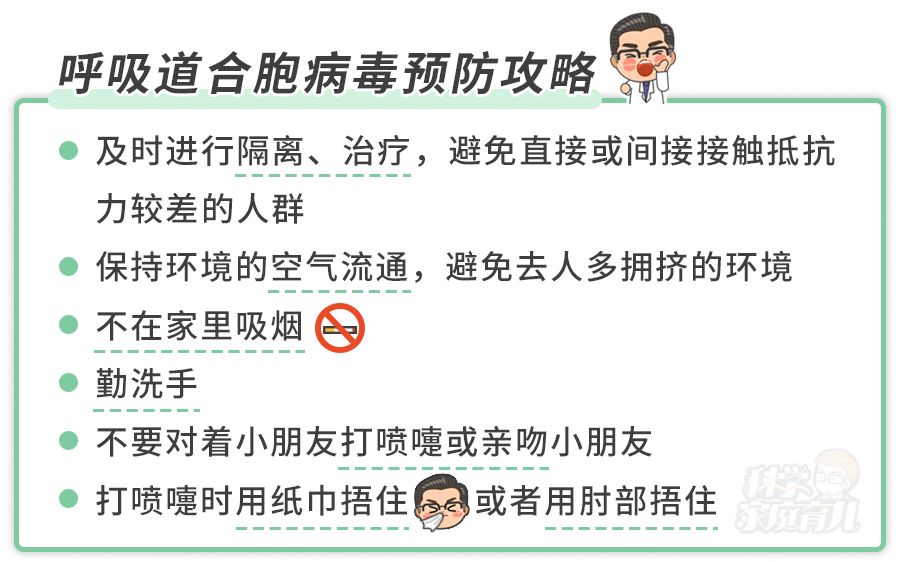

7. How to prevent respiratory syncytial virus?

breast feeding

Because lgA in breast milk has a protective effect on infants, it is recommended that infants breastfeed as much as possible until they are 6 months old.

Image source: scientific family parenting original

Wash your hands frequently.

Wash your hands before eating, after going to the toilet, after going home, etc., and wash them with soap or hand sanitizer for more than 15 seconds each time, which can effectively prevent respiratory syncytial virus.

Image source: scientific family parenting original

Beware of secondhand smoke

The research shows that the infants who have been exposed to secondhand smoke for a long time are 2.53 times more likely to be infected with RSV than those who have not smoked, and the severity of their illness is higher than that of those who have not been exposed to secondhand smoke.

At the same time, smoke deposited on sofas and beds will still have an impact on children’s health and can last for many years.

We try our best to avoid second-hand smoke and third-hand smoke.

Image source: scientific family parenting original

Avoid cross infection

During the high-incidence period, try to avoid taking your baby to crowded places, such as children’s parks, early education institutions, and kindergartens. If there are many children recruited, you can take time off to rest at home for a while.

But if the baby has other symptoms, how should we care?

Respiratory syncytial virus (RSV) is self-limited. Generally, it will start to recover in 7-12 days, but parents need to master the basic condition judgment to avoid excessive anxiety.

For infants less than six months old, in the case of suspected syncytial virus infection, even if the pathogen is not diagnosed, special attention should be paid to evaluating the baby’s breathing and feeding.

Because related infections can easily cause nasal congestion or accelerated breathing in infants, it may be difficult to feed or drink water. If there is no relevant nursing experience, it is recommended to be hospitalized actively.

If infants under 2 months have apnea, they should be hospitalized actively to avoid secondary damage caused by insufficient monitoring.

Mild symptoms, parents can handle.

◆ fever

Observe the baby’s mental state.

If the baby can eat, drink, sleep and play, and is in a good mental state, you can try physical cooling, such as wiping the baby’s forehead, armpits, neck and thigh roots with a towel dipped in warm water.

Image source: scientific family parenting original

If the baby’s axillary temperature reaches 38.5℃ (oral temperature 38.5℃, anal temperature 39℃), the baby over 6 months can take acetaminophen or ibuprofen, and the baby under 6 months should go to the hospital in time.

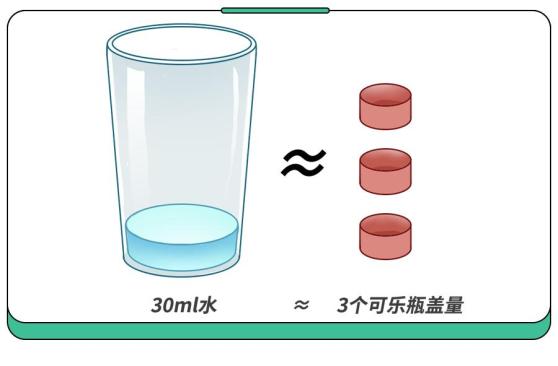

During the period of fever, add more water to the baby, increase the amount of urination and promote the circulation of water in the body. Babies over 6 months can drink about 30ml of water each time.

Image source: scientific family parenting original

◆ Cough

For mild cough in the recovery period of infection, parents can help the baby to discharge throat secretions by inhaling normal saline through atomization.

For infants who already have feeding and eating difficulties, parents are not advised to carry out atomization treatment on their own to prevent the symptoms of airway obstruction from aggravating.

Image source: scientific family parenting original

If it is inconvenient to atomize, you can fill the bathroom with steam, let the baby play in it for a while, and dilute the secretion by inhaling steam.

On this basis, we can help the baby to discharge secretions by knocking on the back.

The department greatly does not recommend blind use of cough medicine.

Because cough is only a symptom, not the cause, and cough can excrete secretions wrapped in foreign bodies and harmful substances, which is helpful to restore the disease.

Blindly relieving cough may cause secretions to stay in the body for too long, which may aggravate the child’s discomfort.

Due to the low survival rate of respiratory syncytial virus in vitro, there is no relevant vaccine listed in China, so we can only focus on prevention.

When a child has a cold for a week and has wheezing, it is necessary to consider that the baby is targeted by respiratory syncytial virus.

Parents don’t have to panic at this time, we can take care of it at home.

Come on, check the nursing Tips ↓

Use a nasal aspirator and normal saline to clean the sticky nose.

Use an air humidifier to make breathing smooth.

Appropriately raising the head position is beneficial to the drainage of nasal secretions.

Give your child a small amount of water many times to ensure adequate water intake.

In fact, this virus is a bit "watching the baby eat dishes". As long as the child’s immune function develops normally and family care is done well, this virus can heal itself.

Seriously ill, go to the hospital quickly.

Although respiratory syncytial virus is self-limited, it may be fatal in severe cases. When the following symptoms appear, parents need to take their children to see a doctor in time:

Difficulty in breathing, breathing hard with the nostrils open, and the muscles under the ribs or chest are depressed inward, and the breathing frequency is greater than 60 beats/min.

Fever > 38.5℃, and there will be repeated fever.

The child’s mental state is poor, and there is irritability, and the feeding amount has dropped by more than half.

Dehydration, dry mouth without tears when crying, no urine or oliguria in diapers for 6 hours, and dry skin.

Conditions such as dyspnea and dehydration cannot be handled by parents, and respiratory syncytial virus can cause pneumonia.

Therefore, in the above situation, you must take your child to the hospital in time and let the doctor carry out symptomatic treatment.

Regarding this virus that can’t be prevented by vaccine, Ke has greatly summarized a wave of issues that mothers are most concerned about:

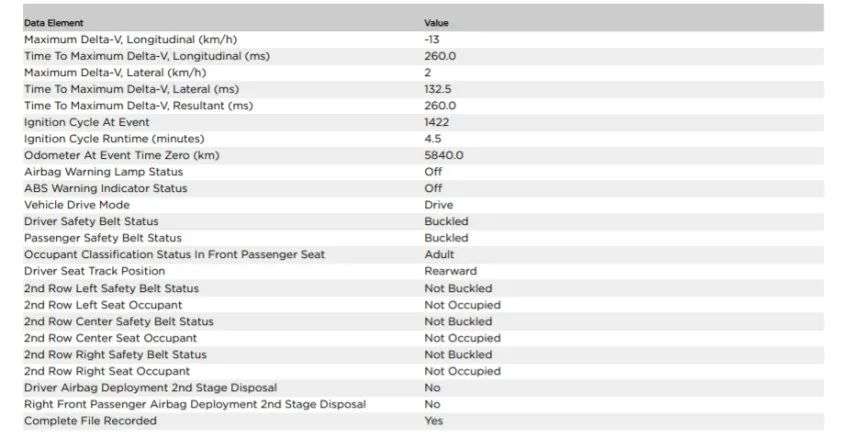

Q1: Is it respiratory syncytial virus infection that children have fever and cough? How will the doctor diagnose when he goes to the hospital?

A: not necessarily! Influenza virus, adenovirus, rhinovirus, parainfluenza virus and some bacteria can all cause these symptoms.

When parents are not sure whether their children are infected with respiratory syncytial virus, they can go to the hospital and ask a doctor for diagnosis.

At present, the known detection of respiratory syncytial virus is carried out by respiratory syncytial virus nucleic acid detection kit, and most of the detected substances are nasal secretions, and the results are obtained in 15-30 minutes.

Q2: It is said that ribavirin can cure respiratory syncytial virus, but isn’t this medicine not for children?

A: Ribavirin has selective inhibitory effect on respiratory syncytial virus, but its clinical effect is uncertain.

Moreover, there is no atomized dosage form of ribavirin in China, and experienced pediatricians will carefully choose to use atomized inhaled hormones, bronchodilators and other treatments to make children more comfortable.

After the symptoms get better, the corresponding symptomatic treatment should be carried out.

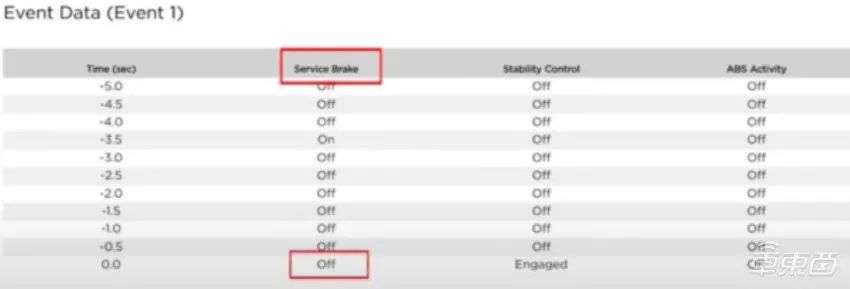

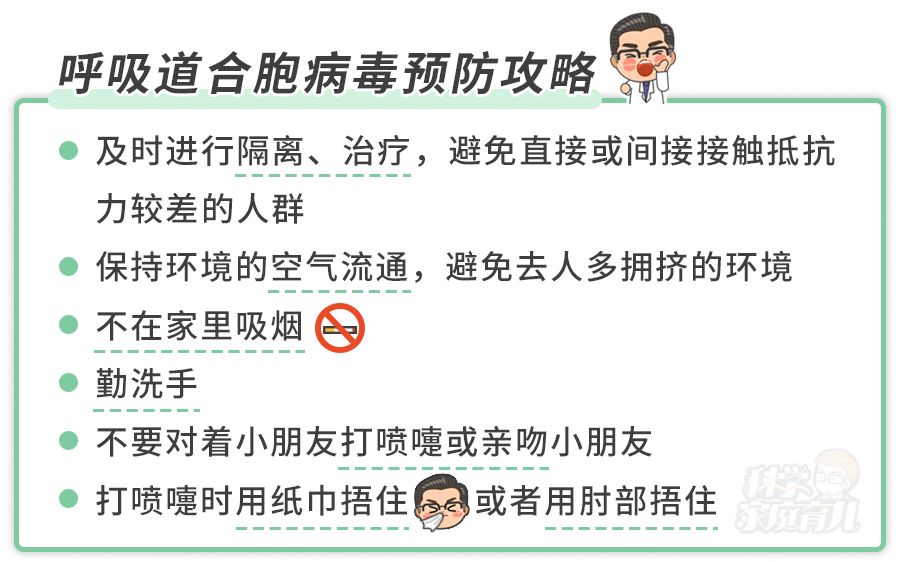

Q3: Since there is no vaccine, how should parents prevent it?

A: What we need to do is to nip RSV in the cradle before it is ready to invade.

How? Come, look at the picture:

In case you get sick, stay at home (dad) and stay (mom). Don’t go out as a demon to infect other children.

If you have any questions, see you in the message area!

★ This article has been reviewed by experts:

Wang Dongchen: Attending physician of pediatric internal medicine in 3A hospital, master of pediatrics, engaged in pediatric clinical work for five years, specializing in children’s respiratory diseases, specializing in the diagnosis and treatment of common diseases in pediatric internal medicine and newborns.

Read the original text